Overtime is defined by the Fair Labor Standards Act as 1.5 times one’s hourly pay rate after working more than 40 hours per week. Generally,individuals employed in bona fide executive, administrative, orprofessional capacities are exempt from Federal and State overtimerequirements under the so-called “white collar”exemptions. Qualification for exemption is not determinedsolely by an employee’s title, job description or the fact thatthe employee is paid on a salary as opposed to hourly basis. Rather, to qualify for this exemption, the employer must show thatthe employee satisfies both a “salary basis” test and a”duties” test. Because the burden is on theemployer to demonstrate that the exemption applies, it is criticalthat employers conduct a thoughtful and careful analysis whenclassifying an employee as exempt.

- Starting January 1, anyone who did not earn a minimum of $35,568 per year, or $684 a week, became eligible for overtime pay for every hour they work beyond 40 hours a week, even if they meet the other two conditions.

- If your company doesn’t pay overtime correctly or violates other labor laws, it could result in an investigation, fines and legal penalties.

- Normally, overtime pay earned in a particular workweek must be paid on the regular pay day for the pay period in which the wages were earned.

- A Biden proposal would raise the threshold under which salaried workers are eligible for overtime pay — but it could face opposition from business groups.

- If a wage determination specifies an electrician’s hourly rate as $22 and their fringe rate as $5 per hour, then their total prevailing rate per hour for all straight-time hours worked under that work classification is $27.

- Many salaried managers in low-wage industries such as retail and fast food are currently exempt from earning overtime pay, even when they work long hours.

- As of January 1, 2020, revisions to the Fair Labor Standards Act (FLSA) set a new salary threshold as to which workers are “exempt.” This opened up the ability to earn overtime pay to millions of workers.

As you might expect, companies may choose to deal with the situation in other ways. Some may not raise salaries but be very conscientious that nonexempt employees never work more than 40 hours per week. Employers at nonprofits, retail companies, hotels, and restaurants with a managerial wage earners are eligible for overtime after 40 hours per week worked title and pay just above the annual threshold were excluded from automatic overtime pay. The new rules changed that, making either overtime pay or a higher annual salary a reality. The new rules affect a variety of Americans, but some groups of workers will see the greatest benefit.

Comp. Time and Overtime: Only After 45 Hours of Work a Week?

Fact Sheet on the Overtime Pay Requirements of the Fair Labor Standards Act (FLSA) (PDF)Provides general information concerning the application of the overtime pay provisions of the FLSA. The department estimated that the rule would result in a transfer of $1.2 billion from employers to employees in its first year. As you can see, there is more to overtime than just calculating time and a half. Let’s take a closer look at overtime, the laws that govern it, and how it applies to government contracts under Davis-Bacon and Related Acts.

- In general, the FLSA does not require breaks or meal periods be given to workers.

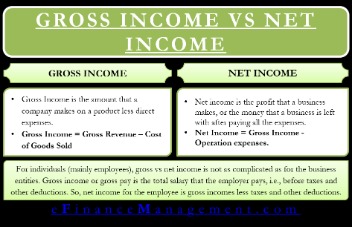

- The regular rate is calculated by dividing the total pay for employment (except for the statutory exclusions) in any workweek by the total number of hours actually worked to determine the regular rate.

- An estimated 1.3 million workers will become newly entitled to overtime protection because of the increase in the salary level.

- It can start on any day, and different workers can have different established workweeks, but it can’t change unless the change is permanent.

- The Fair Labor Standards Act (FLSA) and the Contract Work Hours and Safety Standards Act (CWHSSA) are federal labor laws that directly impact the relationship between employer and employee.

- The new eligibility rule could make 3.6 million more U.S. workers eligible for overtime pay, according to the administration.

- If a State establishes a more protective standard than the provisions of the FLSA, the higher standard applies in that State.

Yes, if an employee does not earn enough in nondiscretionary bonuses and incentive payments (including commissions) in a given 52-week period to retain his or her exempt status, the Department permits a “catch-up” payment at the end of the 52-week period. The employer has one pay period to make up for the shortfall (up to 10 percent of the standard salary level for the preceding 52-week period). Any such catch-up payment will count only toward the prior 52-week period’s salary amount and not toward the salary amount in the 52-week period in which it was paid. If the employer chooses not to make the catch-up payment, the employee would be entitled to overtime pay for any overtime hours worked during the previous 52-week period. The FLSA establishes minimum wage, overtime pay, recordkeeping, and youth employment standards covering employees in the private sector and in Federal, State, and local governments.

Federal Laws Impacting Overtime

Where employers already provide compensated breaks, an employee who uses that break time to express milk must be compensated in the same way that other employees are compensated for break time. In addition, the FLSA’s general requirement that the employee must be completely relieved from duty or else the time must be compensated as work time applies. Both the California Labor Law and the Federal Fair Labor Standards Act (FLSA) state that work performed in one workweek in excess of 40 hours is overtime. Employees are due one and a half times (1.5X) their regular hourly rate, starting at hour 41. This rule will transfer income from employers to employees in the form of wages.

To learn more about the Labor Department’s efforts to promote and achieve compliance with labor standards in place to protect and enhance the welfare of the nation’s workforce, visit the Wage and Hour Division website. The salary test has been a sticking point for years when it comes to overtime pay. Before the rule change, only workers who earned less than $23,600 per year were entitled to overtime pay. Anyone who was just over https://www.bookstime.com/ that amount and met the other two conditions was considered exempt. In a move that could affect millions of workers, the Biden administration announced Wednesday that it was proposing to substantially increase the cutoff below which most salaried workers automatically receive time-and-a-half overtime pay. A total of 8 hours were logged for Saturday under the electrician work classification with a base hourly pay of $12 per hour.